Protection for all ages

Comprehensive coverage

Plan offers you with more choices

peace of mind

Insurance details

Coverage period and Premium payment term

|

Premium payment term |

Until age 98 (or until the basic plan has expired) |

|

Coverage period |

Until age 99 (or until the basic plan has expired) |

|

Issue age |

1 month – 85 years old (until age 98) |

|

Minimum sum assured |

Depends on the plan you have selected |

Benefits

|

Death benefits |

- |

|

Tax benefits |

A health insurance premium, up to a maximum of THB 25,000, is eligible for personal income tax deduction. However, the deduction for this premium together with the life insurance premiums paid cannot exceed THB 100,000 in total, according to the terms & conditions of the Revenue Department. |

|

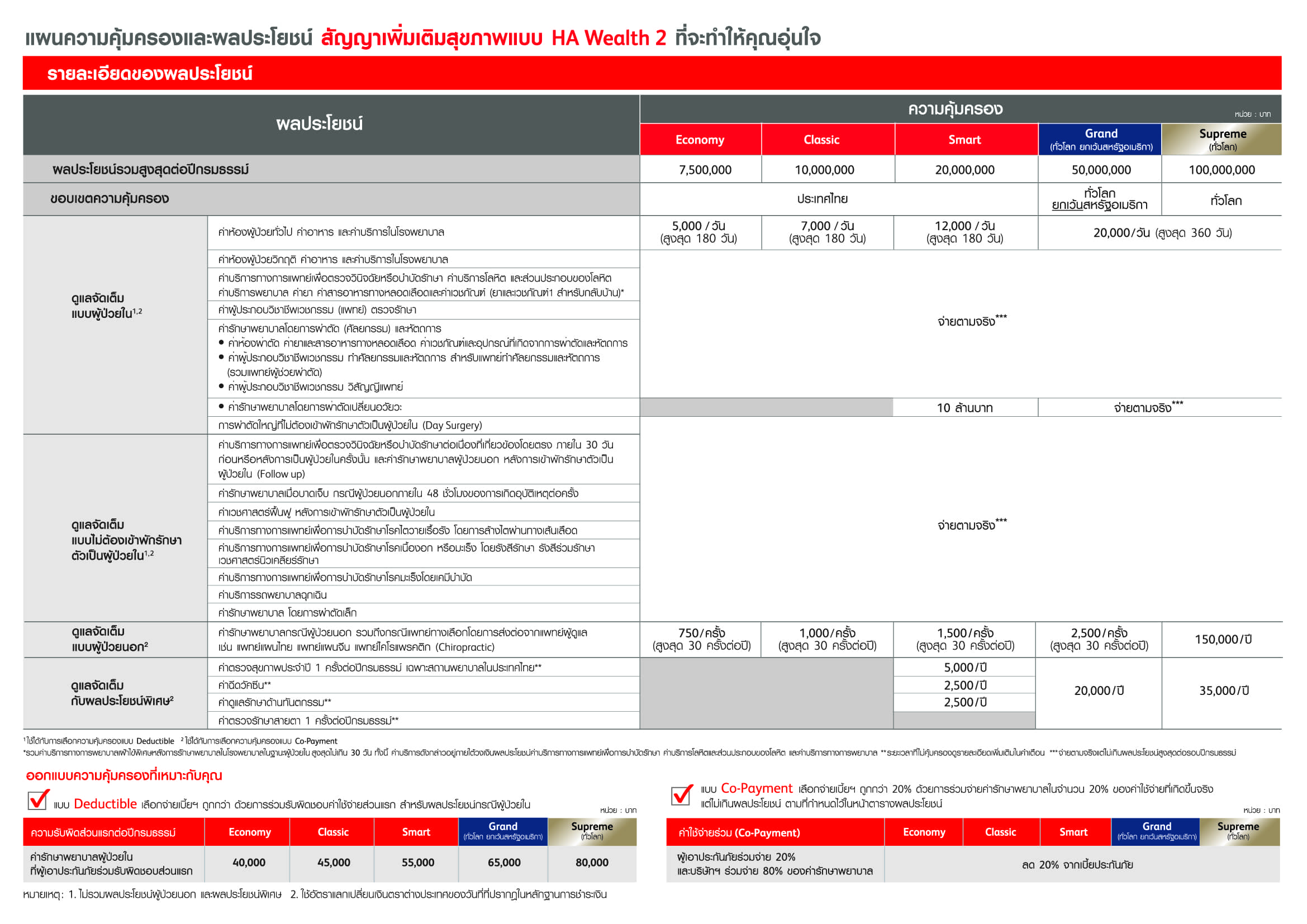

Benefits details |

|

The company will not provide coverage in the following cases

The company will not provide coverage in the following cases : PRUHealth Rich Protection

The company will not pay benefits as specified in this supplementary contract for treatment of Illness, medical expenses commencing within any of the following periods of time from the effective date of this Rider, or on the date that the company has approved to increase the benefit amounts of this Rider, whichever occurs later.

Waiting Period :

-

Any illness occurring within 30 days

-

Health Checkup, Vision and Eye Care or Vaccination occurring within 12 months

-

Dental Treatment occurring within 90 days

-

Any of the following illnesses that occur during the 120 days

- Tumor, Cyst, or all types of cancer

- Hemorrhoid

- All types of hernia

- Pterygium or Cataract

- Tonsillectomy or Adenoid

- All types of stone diseases

- Varicose veins in the leg

- Endometriosis

In case the company approves to increase the benefit amounts, the company shall not cover only the increasing benefit amount. And “covered period” conditions shall not apply if the insured suffers the injury or undergoes an emergency operation which is not caused by a pre-existing condition.

Examples of Exclusions: PRUHealth Rich Protection

-

Condition arises due to functional birth defect or structural birth defects, or genetic disorder, abnormal physical development.

-

Cosmetic surgery or treatment, or treatment for skin problems, acne, melasma, freckles, dandruff, hair loss or body weight control, or any optional surgery except for wound care and dressing caused by covered accidents.

-

Pregnancy, miscarriage, abortion, delivery, pregnancy complications, fertility and infertility treatment (including evaluation), sterilization or contraception.

-

AIDS or venereal disease or sexually transmitted diseases.

Note**

-

This is a life insurance product, not a bank deposit. To get the maximum benefits from insurance policy, the applicant should continuously pay the premium through to the end of the premium payment period and holds the policy until the end of the policy contract. If the policy is terminated before the end of the contract, the applicant may not receive cash benefit in the amount equivalent to the maximum policy benefit he/she is entitled to, or in the amount equivalent to all premiums paid.

-

The insured is responsible for paying premium. An insurance agent or broker that accepts a premium payment by the insured is solely for the purpose of providing service to the insured.

-

The applicant should understand coverage details and conditions thoroughly before deciding to buy an insurance.

-

“PRUHealth Rich Protection” is a marketing name of HA Wealth 2 Rider.

-

The company may adjust the premium on the policy anniversary date based on age and occupation class change of the insured person and/or increasing of medical expenses and/or claims experience portfolio under this rider which have been approved by the registrar, and the company will send prior written notice to the insured at least 30 days.